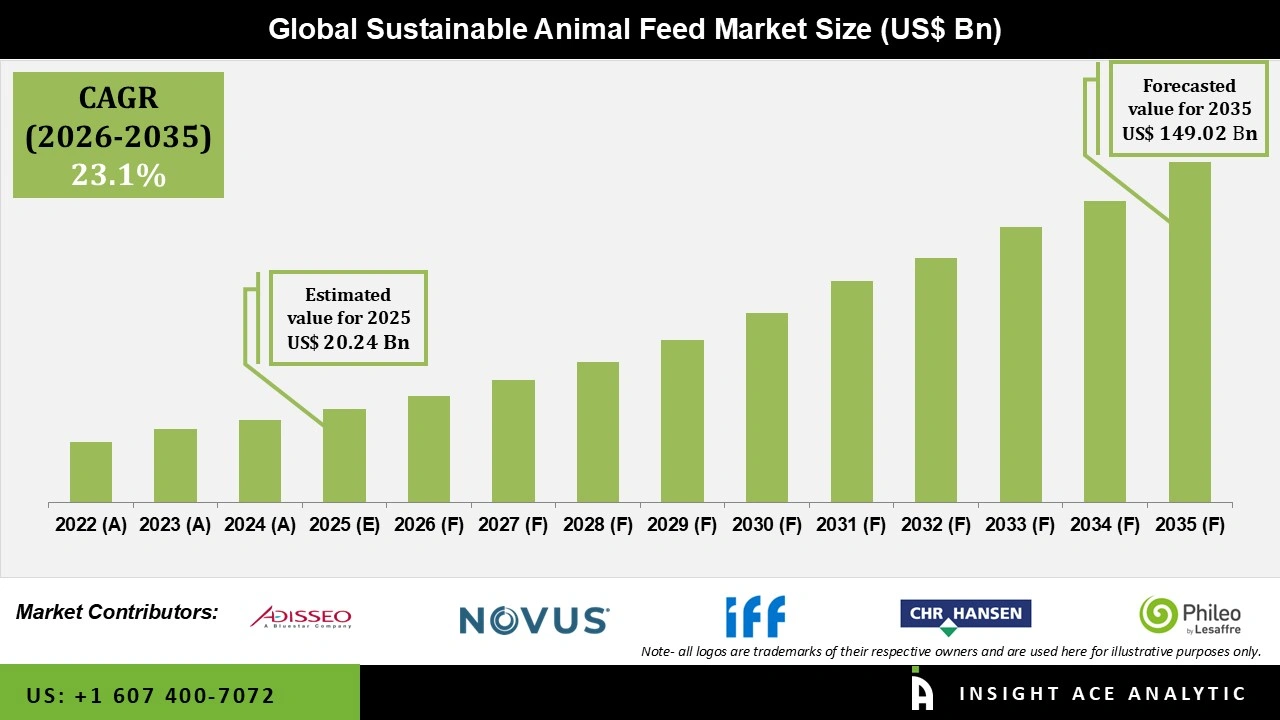

Global Sustainable Animal Feed Market Size is valued at USD 20.24 Billion in 2025 and is predicted to reach USD 149.02 Billion by the year 2035 at a 23.10% CAGR during the forecast period for 2026 to 2035.

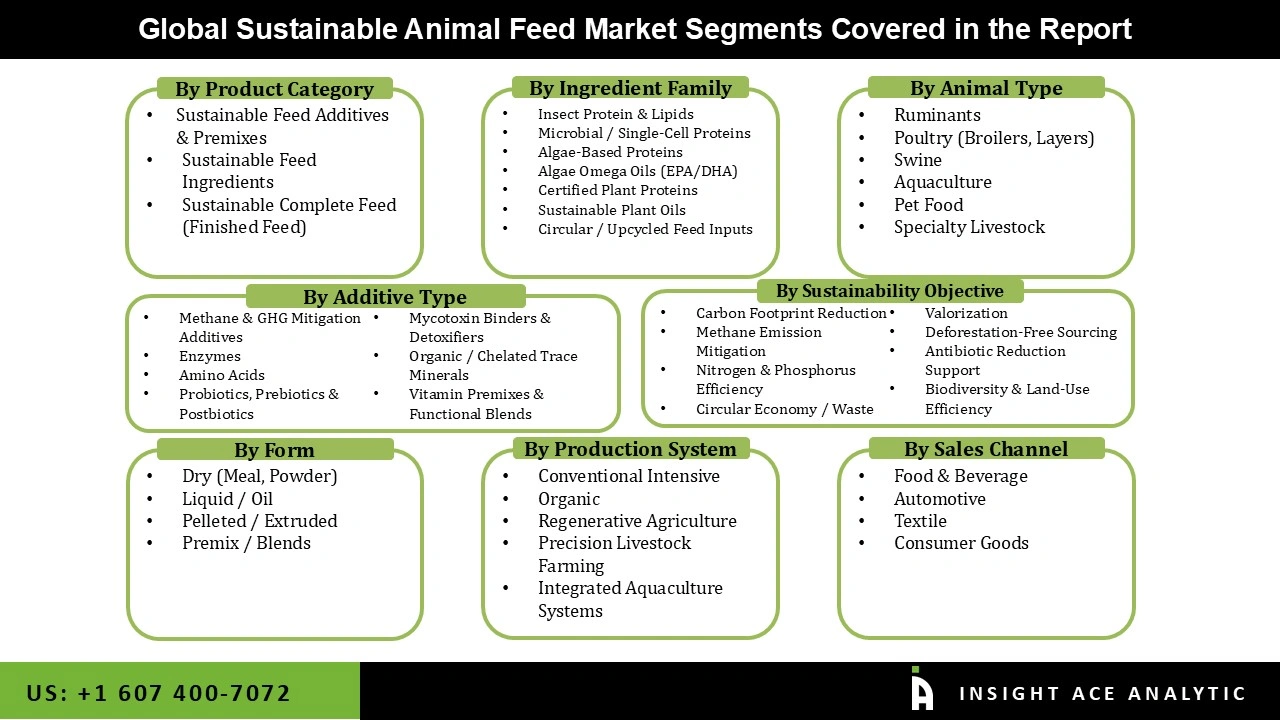

Sustainable Animal Feed Market Size, Share & Trends Analysis Report By Product Category (Sustainable Feed, Additives & Premixes, Sustainable Feed Ingredients, Sustainable Complete Feed (Finished Feed), By Additive Type (Methane & GHG Mitigation Additives, Enzymes, Amino Acids, Probiotics, Prebiotics & Postbiotics, Mycotoxin Binders & Detoxifiers, Organic / Chelated Trace Minerals, Vitamin Premixes & Functional Blends), by Ingredient Family, by Animal Type, by Sustainability Objective, by Form, By Production System, By Sales Channel, By Region, and Segment Forecasts, 2026 to 2035.

Animal feed is essential to the livestock production system. That's because feeding has a direct impact on the productivity, health, and welfare of animals. Sustainable animal feed solutions accelerate growth feed efficiency and improve animal health and the quality of animal products. They are financially advantageous and bring environmental benefits too. The foremost factors driving the growth of the sustainable animal feed market include the growing consumption of meat and animal-based products across different regions, increasing demand for animal protein, population growth, rising changes in diet, innovation of new sustainable products by companies, growing health awareness among consumers regarding the consumption of animal protein, and the availability of digital resource guides for enhancing the overall sustainability of the animal and environment systems. The increased demand for animal proteins encourages companies and organizations involved in the food supply chain to develop safe and quality animal products. It creates the need for resources and information specific to feed sustainability, thereby boosting the growth of the sustainable animal feed market.

However, the high cost of animal feed, limited knowledge of new medical technologies, and various environmental and safety regulations associated with feed sustainability are expected to hinder the market's growth over the forecast years.

In the sustainable animal feed market, sustainable feed additives and premixes are among the leading product categories. The segmental growth is due to delivering targeted improvements in feed efficiency, animal health, and environmental performance with low inclusion rates and quick integration into existing feed systems. Feed additives enable quick reductions in nutrient excretion, antibiotic use, and methane emissions without altering base feed formulations, supporting regulatory compliance and sustainability goals and thereby accelerating segment growth.

By animal type, poultry (broilers and layers) clearly leads, driven by massive global demand for affordable, quick-cycle protein sources. Short poultry production cycles enable faster adoption of sustainable feed solutions, thereby driving market growth. Moreover, Aquaculture is anticipated to be the fastest-growing segment, propelled by the urgent need for marine-sparing feeds (e.g., algae and insect replacements for fishmeal/oil) to sustain expansion amid concerns about overfishing and eco-certification demands.

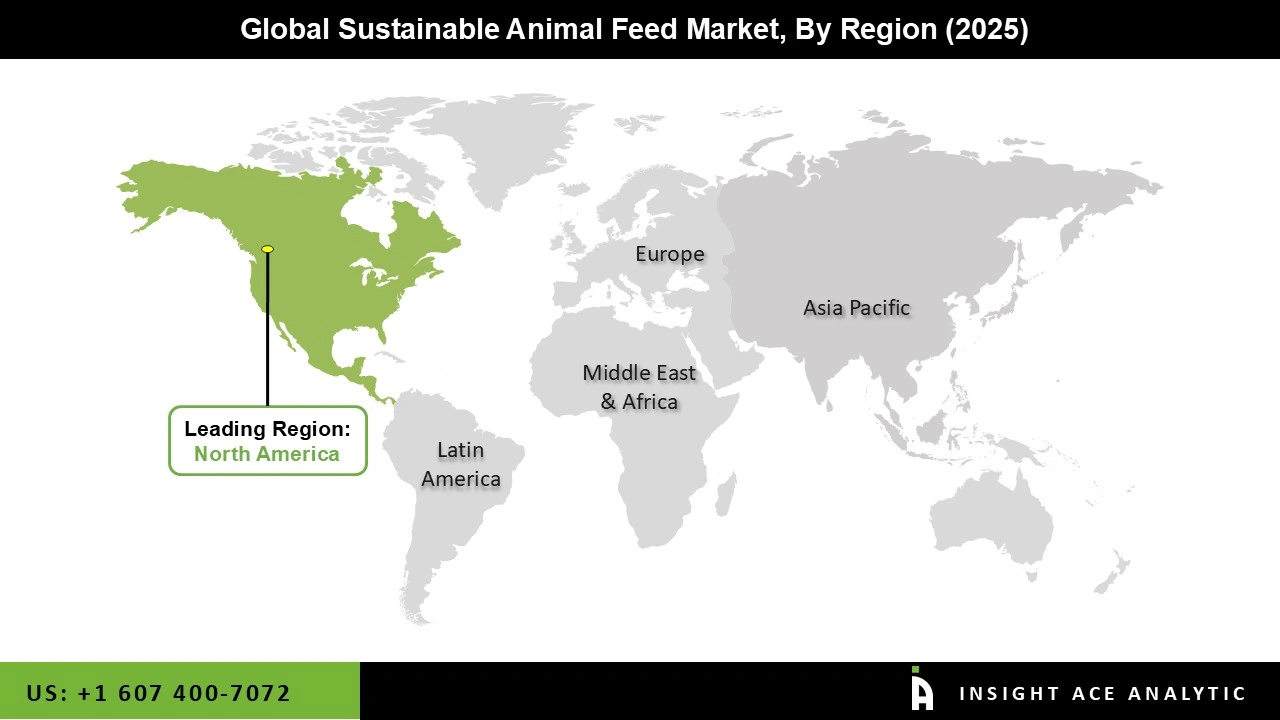

The regional growth is characterized by advanced technological adoption, significant R&D investment in precision nutrition, and growing corporate sustainability commitments from major producers and retailers. The region is rapidly focusing on scaling methane & GHG mitigation additives for ruminants, enzyme applications to improve efficiency, and alternative proteins to enhance feed conversion, while addressing environmental concerns such as nutrient runoff and emissions.

Factors such as high per-capita meat consumption, large-scale commercial operations (especially poultry and beef), and innovation in functional blends are also further driving the regional growth.

| Report Attribu | Specifications |

| Market Size Value In 2025 | USD 20.24 Billion |

| Revenue Forecast In 2035 | USD 149.02 Billion |

| Growth Rate CAGR | CAGR of 23.10% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn,and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026 -2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Ingredient Type, By Product, By Livestock |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Cargill, Incorporated, Archer Daniels Midland (ADM), dsm-firmenich, Evonik Industries AG, BASF SE, Nutreco N.V., Alltech Inc., Kemin Industries, Adisseo, Novus International, IFF (Danisco Animal Nutrition), Chr. Hansen Holding A/S, Phileo by Lesaffre, Elanco Animal Health, Zoetis, Protix, InnovaFeed, Ynsect, Entobel, Hexafly, nextProtein, Beta Hatch, EnviroFlight, Calysta, Unibio, Deep Branch Biotechnology, String Bio, Corbion, Veramaris, Fermentalg, Euglena Co., Ltd., BlueBioTech, Algal Scientific, BioProcess Algae LLC, MicroBio Engineering (MBE), Inc., SabrTech, Global Algae Innovations, Culture BioSystems, Sea Forest, Symbrosia, Volta Greentech, MEGA Tierernaehrung GmbH and Others. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.