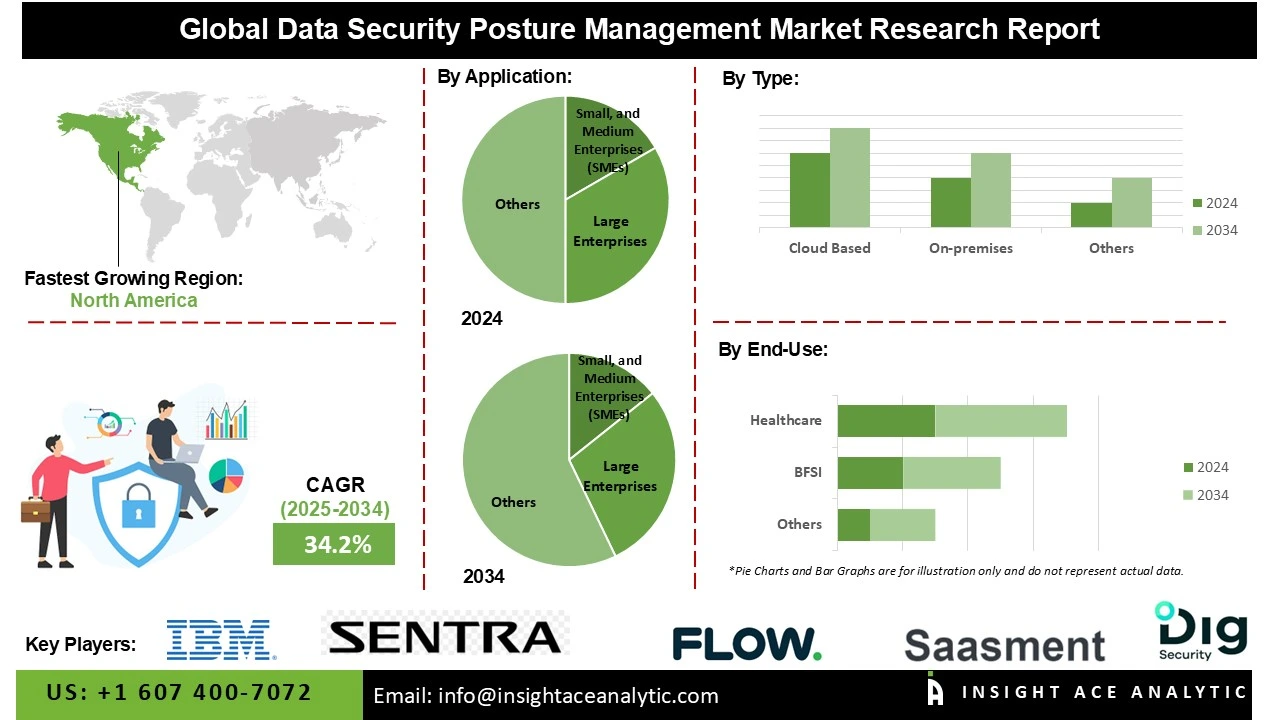

Data Security Posture Management Market Size is predicted to grow at an 34.2% CAGR during the forecast period for 2025-2034.

Data Security Posture Management is a cybersecurity strategy that emphasizes safeguarding an organization's sensitive data, regardless of its location. In contrast to conventional tools that secure networks or endpoints, DSPM automatically classifies and discovers data across cloud environments, identifies risks such as misconfigurations and excessive user permissions, and prioritizes remediation.

DSPM ensures compliance with regulatory standards and prevents data breaches by offering continuous visibility into the storage, access, and utilization of data. The Data Security Posture Management market is expanding rapidly in the industrial sector due to the increasing requirement for operational efficiency and secure digital transformation. Industries are increasingly integrating IoT, IIoT, and cloud-based platforms, which expose crucial data to cyber risks.

DSPM solutions assist monitor, assess, and remediate security gaps in real-time, ensuring regulatory compliance and minimizing operational disruptions. The requirement to protect sensitive operational and production data while optimizing workflows drives adoption. Additionally, industrial organizations are investing in automated, scalable, and centralized security management solutions to expand efficiency, decrease human error, and allow continuous industrial operations.

The data security posture management market is expanding rapidly as organizations increasingly adopt advanced technologies like cloud computing, AI, and machine learning, which generate complex and distributed data environments. This complexity elevates the risk of misconfigurations, vulnerabilities, and compliance violations, creating a critical requirement for continuous security monitoring. DSPM solutions assist enterprises identify, assess, and remediate data risks across hybrid and multi-cloud environments. Rising regulatory mandates, growing cybersecurity threats, and the increasing reliance on automated, AI-driven security analytics are driving organizations in Europe and globally to adopt DSPM for robust data protection and operational resilience.

Some of the Key Players in the Data security posture management Market:

The Data security posture management market is segmented by application, type, end-use and By Region. The application segment includes banking, financial services & insurance (BFSI), healthcare, retail & e-commerce, IT & ITeS, government, and others. By type, the market is segmented into on-premises, and cloud. By end-use, the market is segmented into small & medium enterprises, and large enterprises.

In 2024, the cloud held the major market share due to the rising need to continuously monitor cloud configurations, detect misconfigurations, and prevent data breaches drives adoption. Regulatory compliance mandates, including GDPR and CCPA, necessitate organizations to enhance their cloud security measures. Additionally, rising cyber threats, digital transformation initiatives, and the demand for automated, real-time visibility into cloud assets further accelerate the deployment of DSPM solutions across industries.

The data security posture management market is dominated by financial services, & insurance (BFSI) due to the increasing complexity of digital banking, cloud adoption, and the rise of cyber threats. Financial institutions handle sensitive customer data, making robust security essential. Regulatory compliance, such as GDPR and PSD2 in Europe, drives the need for continuous monitoring and risk assessment. DSPM solutions help identify misconfigurations, enforce security policies, and prevent data breaches. The growing adoption of AI-driven analytics and automation for real-time threat detection further propels market growth in BFSI.

North America dominates the market for data security posture management due to region’s growing need for continuous monitoring and management of cloud and on-premises data security. Increasing cyberattacks, stringent data privacy regulations, and rising adoption of cloud services drive enterprises to strengthen their data security posture. Organizations are investing in automated tools to identify vulnerabilities, ensure compliance, and prevent data breaches. The emphasis on proactive risk management and real-time threat detection further fuels market growth across industries in the region.

Moreover, Europe's Data security posture management market is also fueled due to growing concerns over data breaches, regulatory compliance, and increasing cloud adoption across enterprises. Organizations are focusing on identifying misconfigurations, security gaps, and vulnerabilities in real time to protect sensitive information. Stringent GDPR regulations and rising cyber threats push businesses to adopt DSPM solutions. Additionally, the shift toward hybrid and multi-cloud environments, coupled with the need for continuous monitoring and automated risk management, further drives market growth in Europe.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 34.2% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Application, By Type, By End-Use and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Bentley Systems, Inc., Dassault Systems SE, HTC Corporation, Magic Leap, Inc., Microsoft Corporation, NVIDIA Corporation, PTC Inc, Siemens AG, Swanson Analysis Systems Inc., and Unity Software Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Data Security Posture Management Market by End-Use-

· Banking, Financial Services & Insurance (BFSI)

· Healthcare

· Retail & E-Commerce

· IT & ITeS

· Government

· Others

Data Security Posture Management Market by Type-

· On-Premises

· Cloud

Data Security Posture Management Market by Application-

· Small and Medium Enterprises

· Large Enterprises

Data Security Posture Management Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.